What’s the Difference Between Survey Data and Modeling Data?

You have a burning question. One thing you need to know to target your ideal audience. But how do you find the answer? Simple: Ask.

Polls and surveys are an effective, reliable way to obtain self-reported insight about a sample population. They can tell you a lot - how people think, feel, or behave - around a topic of interest.

But at best, you’re polling a limited portion of the population you want to reach, and there are millions more people out there who think the same way as your surveyed sample. This is where the difference between survey data and modeled data becomes vital to your campaigns.

It’s a question we get asked often here at Tunnl because we deal with both. We conduct widespread surveys every quarter to collect new and refreshed survey data that gets crunched with decades of historical data and contemporary information to create accurate models that expand your understanding of your audience.

We’ll walk you through what sets survey data and modeled data apart and show you how they work together to become accurately targeted audiences. You’ll get a quick summary to explain to stakeholders, too. By the end, you’ll be analyzing your data like a pro with a clearer understanding of where it came from and how it can influence your campaigns.

Survey Data vs. Modeled Data: Going from Polls to Probabilities

Survey data and modeled data are both critical components to understanding your audience. They are both steps in the audience-building process, different evolutions of the same information. Here’s the role each data type plays and how they come together.

What is Survey Data?

Survey data is what you get from polling a group of people. The results are a target sample’s answers to questions about a specific topic or area of interest. If you work with pollsters like Axis Research, Morning Consult, or Public Opinion Strategies, you've likely seen this type of data before.

“The raw data you get from the survey is just a reflection of a point in time,” says Elise Katz, Senior Director of Account Management. “The people from your sample who happened to respond, how they think at that moment - that’s survey data.”

This data shows how a representative sample of your target group may feel. But when it’s time to put that information into action, you may want modeled data on your side.

What is Data Modeling?

You conduct a survey because you want to know which messages move people and how they feel about your issue or brand. And survey data can show you that, but it only empowers you to target the sample you polled. What about the rest of the world?

You conduct a survey because you want to know which messages move people and how they feel about your issue or brand. And survey data can show you that, but it only empowers you to target the sample you polled. What about the rest of the world?

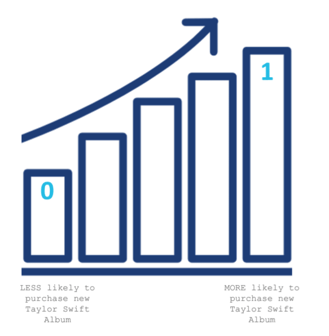

Data models use your survey results to enhance your audience intelligence. During the data modeling process, details about a respondent are charted along with their survey responses, creating a more complete, predictive picture about who favors particular answers. The result is a probability - displayed as a score between 0 and 1 - showing how likely someone else is to answer in a similar way based on traits they share with people you actually polled.

“Survey data shows you how a select sample of people in a certain geography felt about an issue at a particular point in time,” says Elise Katz, Senior Director of Account Management. “Modeled data takes that a step further so you can accurately reach everyone in the geography that you’re interested in, rather than just the 500 people you surveyed.”

Survey data is the foundation of a data model. Models are the foundation of Tunnl audiences. They are building blocks that ladder you to your audience.

How to Explain the Difference Between Survey Data and Modeled Data to Your Stakeholders

Adding new methods to your advertising strategy is a team sport. Whether you’re deciding on new tech or changing your audience identification process, you’re probably working in tandem with other stakeholders to make it happen. They need to understand the difference between survey data and modeled data, too.

So, here’s how to summarize it:

Survey data shows the raw results of polling a sample group about a specific issue. It evolves into modeled data, which Tunnl uses to develop our prebuilt audience library, custom audiences, and Opinion Makers audiences like U.S. Policy Opinion Makers. Modeled data uses survey data to predict how other people who share characteristics with your sample would respond to your survey questions. The modeled data you receive is displayed as a probability between zero and one, showing how likely people are to choose one response over the others.

In short, pollsters use survey data to tell you which messages move people. We use modeled data to tell you which people are moved by which message.

Getting everyone on the same page about these different, dependent data types will accelerate your audience-building experience.

What Type of Data Does Tunnl Deliver?

At Tunnl, our end product is an audience - an actionable, aggregated data presentation that enables you to advertise more accurately and efficiently. How we build audiences is a multi-step process, and it starts with survey data. We use a variety of surveying methods and polling partners to ask the questions you need answers to - but then we take it a step further.When you work with us to create a custom audience, you will see modeled data. The survey responses themselves will not come across your inbox, but you won’t need them. With our models and audiences, you’ll have everything you need to reach the right people with the most moving message in the most effective places.

“We're crunching billions of data points during the modeling process,” says Elise Katz. “The key difference to highlight here is that traditional survey research and the raw results track what messages move the needle, and we’re looking at who will be most receptive to that message.”

Survey data is built into the results you receive, the same way modeled data is the basis of Tunnl audiences.

How to Use Data Modeling for Your Organization

Survey data and modeled data both have a place in your ad efforts. You may already be using valuable insights about your audience from surveys and pollsters. But there’s more potential in that information. Supplementing survey data with modeled data will earn you a deeper, expanded understanding of your target audience using the data you - or Tunnl - already possess.

When it’s time to take your survey results a step further, you’ll want to know what to expect from the custom audience creation experience with Tunnl and be prepared for how we work with pollsters. In all of our partnerships, you and your goals stay at the center to keep everyone on track.

And if the value of these different data types is still elusive for you, seeing them in action may do the trick. We’d be happy to show you how they play a part in connecting you to your ideal audience.